🏡 Recession ≠ Correction ≠ Crash

Construction jobs are at risk. Home prices will survive this climate.

Recession ≠ Correction ≠ Crash

Recession: Likely

Correction: Maybe

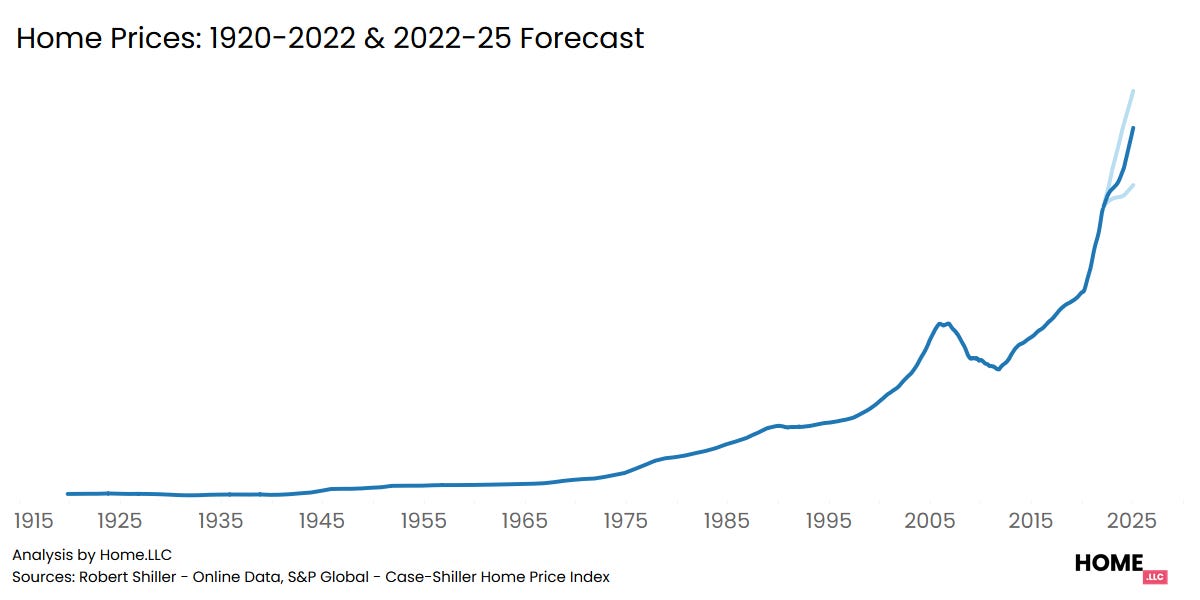

Crash: Unlikely

Recession

Housing Recession = Loss in Construction Jobs

In the last 10 years, home builders have been busy.

But, housing supply doesn’t have a cartel like oil suppliers have OPEC.

So, most builders & many city councils got overzealous & overbuilt inventory.

As a result, months of supply from new construction is >400% that of resale units!

So now, builders are stopping new projects while trying to sell off current projects.

Once builders start trimming jobs en masse, construction will see a housing-related recession.

And since construction jobs are a material part of overall jobs, we could a national headline recession as well.

BUT

Currently, we project:

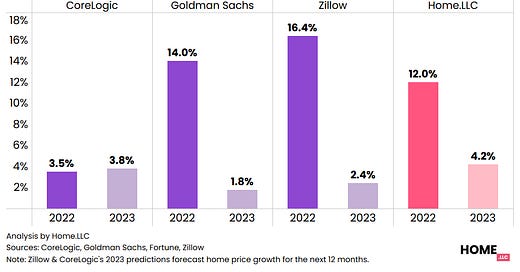

12% Appreciation in 2022

4.2% Appreciation in 2023

4 reasons why home prices will keep growing

1. Massive undersupply

2. Decreasing supply

Supply from resales will keep decreasing because 90% of mortgage holders have a <5% mortgage. Most will become a landlord instead of selling their home.

3. High residual demand

4. Conservative lending

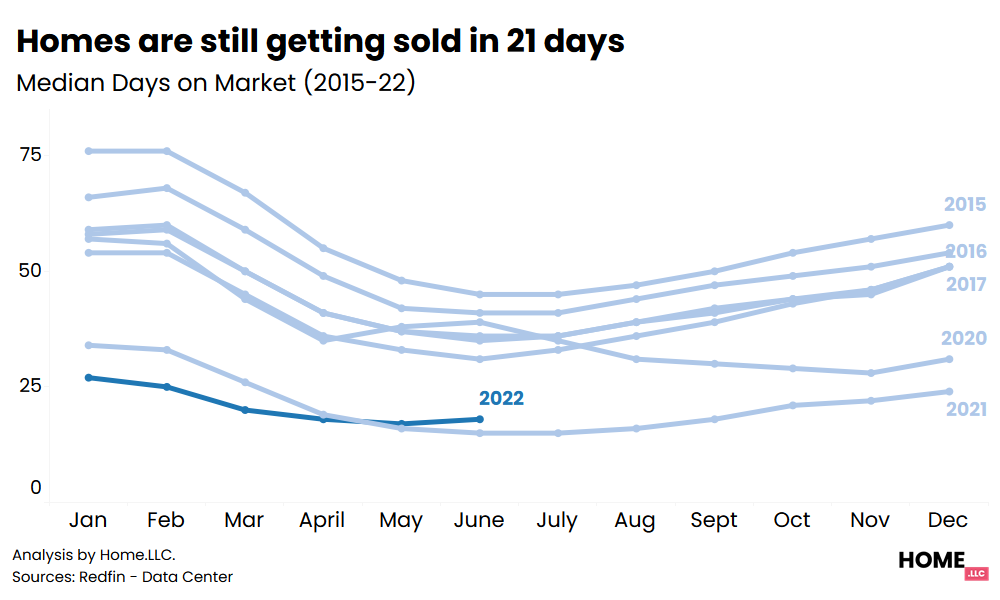

The evidence is clear

And…

But, some cities are at a high risk

Some might correct by 5-10%. Then, they’ll quickly bounce back.

Almost none will crash by 20% (excluding seasonality).

Why? Some cities have massively overbuilt housing inventory.

You can read more here.

*IF* there’s a crash…

The Fed will reverse course

3 interventions from the federal government:

Pare or reduce benchmark rates

Resume QE of RMBS

Resume mortgage forbearance

This will protect housing equity by sacrificing debt.

And, then, we’ll see another spike in home prices.

What do you think?

Our belief? Never bet against America.

Note: All statements above are subject to revisions based on changing assumptions and market conditions. Figures could be rounded by +-10% for improving readability. We are neither a tax advisor nor a financial advisor and none of our statements should be interpreted as tax advice or financial advice.

Agree with the heading that once doesn’t mean another and quite often doesn’t, there are many factors. Impossible to know where anything is headed but not sure I agree that prices will appreciate.

But if housing crashes (-5 to -15%) the fed can’t just reverse course if they actually believe in fighting inflation and inflation proves sticky.

Of course, they can reverse course but strap in for inflation. Also strap in for a dragging economy where no one continues to want to work. Politically we have continued to announce stimulus and other stimulating policies. Why work for the same wage when you can just wait for the next stimulus or stock bump with low rates and QE?

If monthly payments equal affordability than today a 550k house is the same monthly payment as 800k (estimated, not sure what rates are exactly as of post)

But your discussion points have way more data, I’m just off put by how unaffordable and speculative real estate has been in the last 2 years.

Greta analysis 🙏 thank you