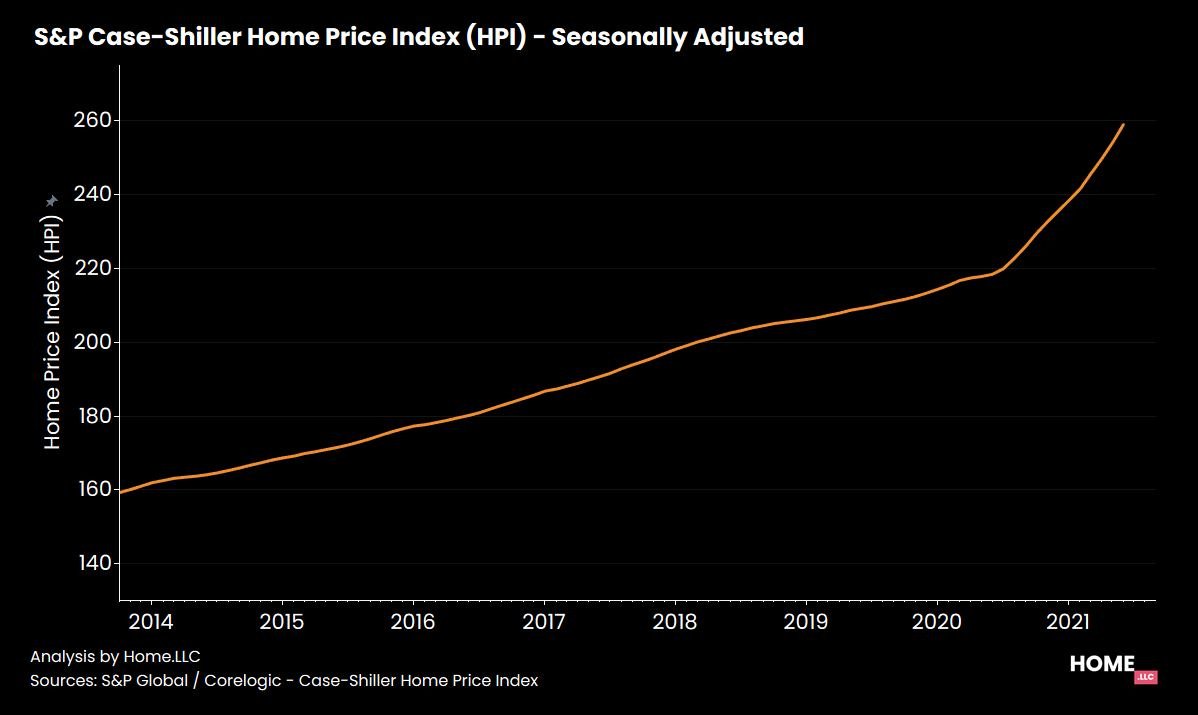

The US housing market has been red hot since the beginning of the pandemic. Home prices have grown by 18.6% over the past 12 months.

Why have home prices grown at such high rates? Most people think that it’s because of a low supply of for-sale homes. We agree, and explained why in our last post. But there’s a lot more to this story.

High demand for homes has been the other big US real estate story of 2020. And one group of buyers has been the driving force behind this rise in demand: Millennials.

Millennials drove demand for homes during the pandemic

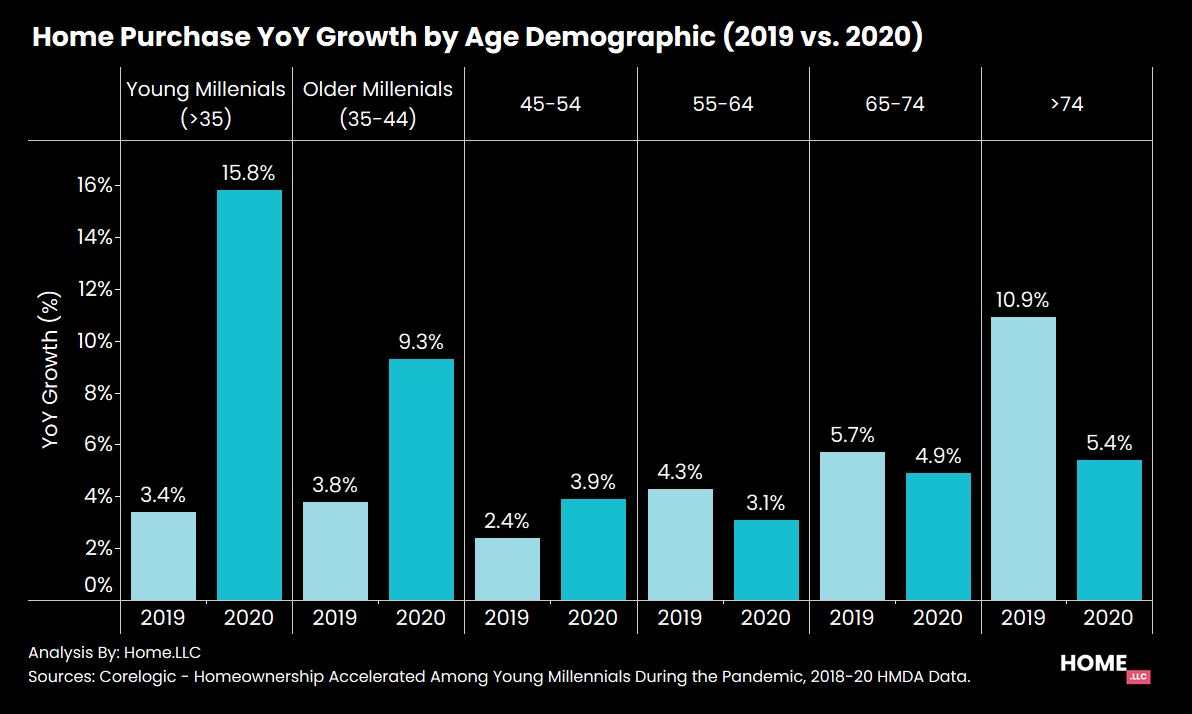

Millennial demand surged during the pandemic. As Corelogic’s Yanling Mayer noted: Compared to 2019, in 2020 - younger millennials had the fastest growth in home purchases. They bought 16% more homes, followed by older millennials, who bought 9% more homes.

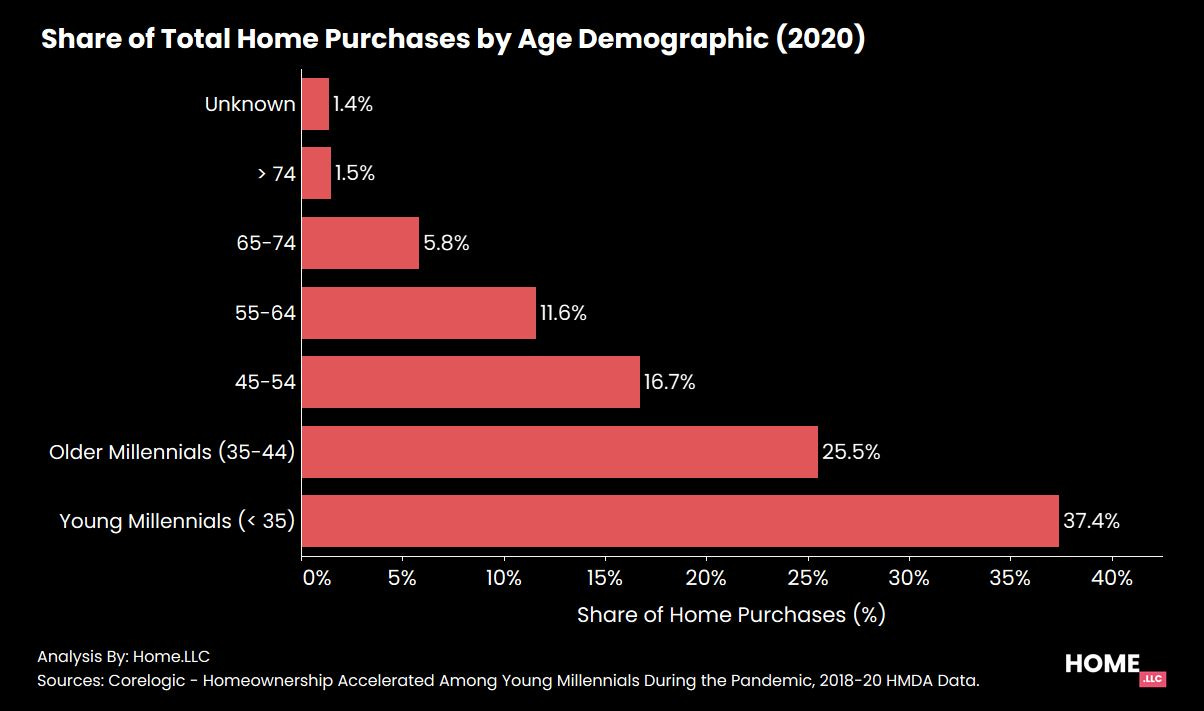

Millennials accounted for >60% of all purchases in 2020

But, Millennials still have a catching up to do

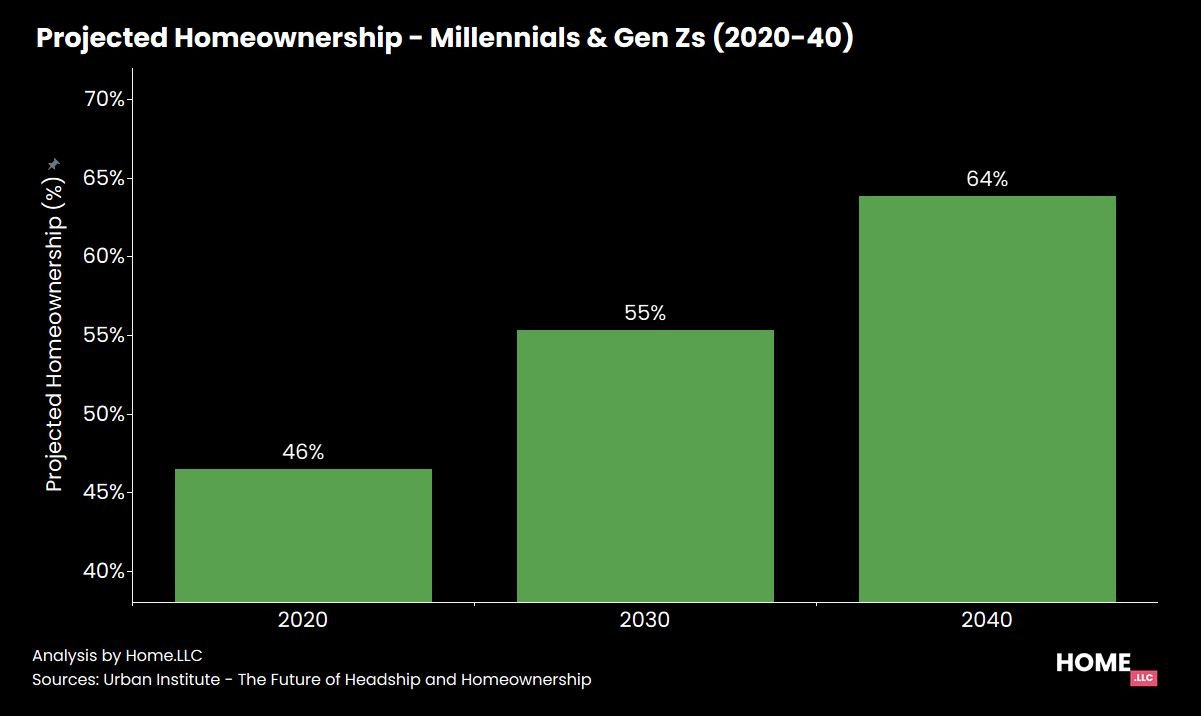

In 2020, Millennial & Gen Z homeownership is lagging Boomers & Gen X by 7 percentage points.

Millennials and Gen Zs have a homeownership rate of 46%. At the same age, Boomers and Gen Xers had a homeownership rate of 53%.

We wrote an article explaining why. Some reasons are:

Increasing age of marriage

Tighter underwriting criteria

More minorities without generational wealth

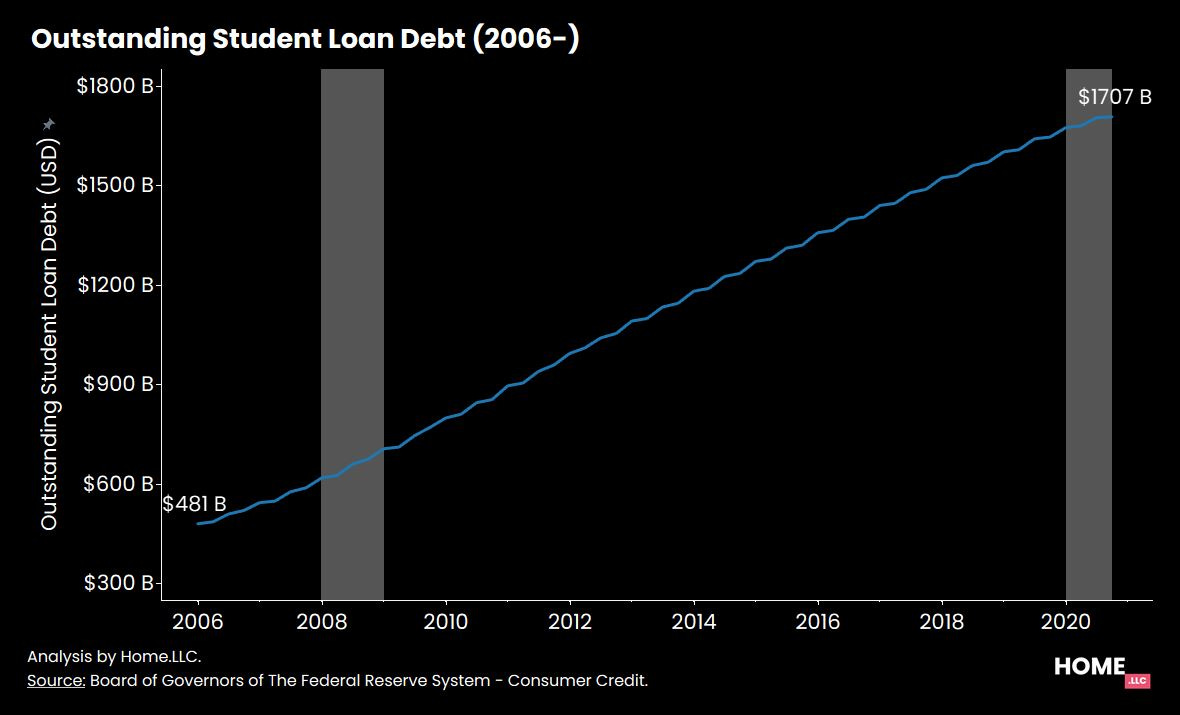

Higher levels of debt

To take one example: student loan debt has tripled in the last 15 years from $480B to $1.7T!

So, what changed in 2020?

Now, Millennials are at their Prime Homebuying Age

Millennials are approaching their peak homebuying age.

Here’s what Realtor.com’s George Ratiu had to say about that:

The oldest millennials are turning 40 this year, and they want more space for their growing families.

First-time buyers are also ready to build equity, have more space, and take advantage of low relatively mortgage rates

How long will this last?

Millennials & Gen Zs Will Drive Homeownership For Next 2 Decades

Researchers at Urban Institute predict that Millennials and Gen Zs will increase their homeownership rate from 46% in 2020 to 64% in 2040.

Combined, they now account for close to 50% of the total US population.

So, Home Prices will keep Increasing!

With inventory of homes for sale still very low, and with millennial demand boosting homeownership, expect home prices to keep on increasing over the next few years.

Family Offices like Daniel Galvanoni’s are now Betting Big on Single Family Homes!

Daniel Galvanoni majored in religion and was a Division I basketball player. Now he’s managing $2B+. Here’s what he told us in an exclusive interview.

Q. How did you go from majoring in Religion to starting DPG?

First of all, to understand a person you have to understand their beliefs. Who is their God? What is their God? If you can understand that, you can have a better-informed basis for interacting with your counterparty and might be able to influence them more and collaborate with them more effectively.

Q. How did COVID-19 impact different asset classes in real estate? Which asset classes are you now bullish or bearish on?

COVID further created the haves and have nots in real estate per the asset classes. Multi-family and master planned single family are red hot. Office, senior care, hospitality, and various other markets were completely crushed.

Read more about Daniel’s perspectives and other real estate family offices on home.llc/interviews.

If you liked this post, help us spread the word:

If you’d like to unsubscribe, here’s a quick way: