🔵 U.S. Housing Inventory is Rapidly Increasing. Now What? 🏡

Let's unpack the supply-side of US residential real estate

Housing inventory, i.e., the total number of homes available for sale, is finally increasing. Inventory has risen by 262,000 units since January 2021, after months of steep declines during the early months of the Covid-19 pandemic.

Does that mean we are back at “normal” inventory levels?

No. We aren’t.

There still aren’t enough homes available for sale

As the above graph shows, housing inventory is still very low, compared to long-term historical trends.

In fact, there are more realtors in the US (1.46 million) than there are houses for sale (1.43 million)!

Housing inventory has been on a declining trend since the early 2010s. And it’ll take a long time for it to catch up to normal levels.

Here are 2 reasons why housing inventory is so low

1. People are living in their homes longer

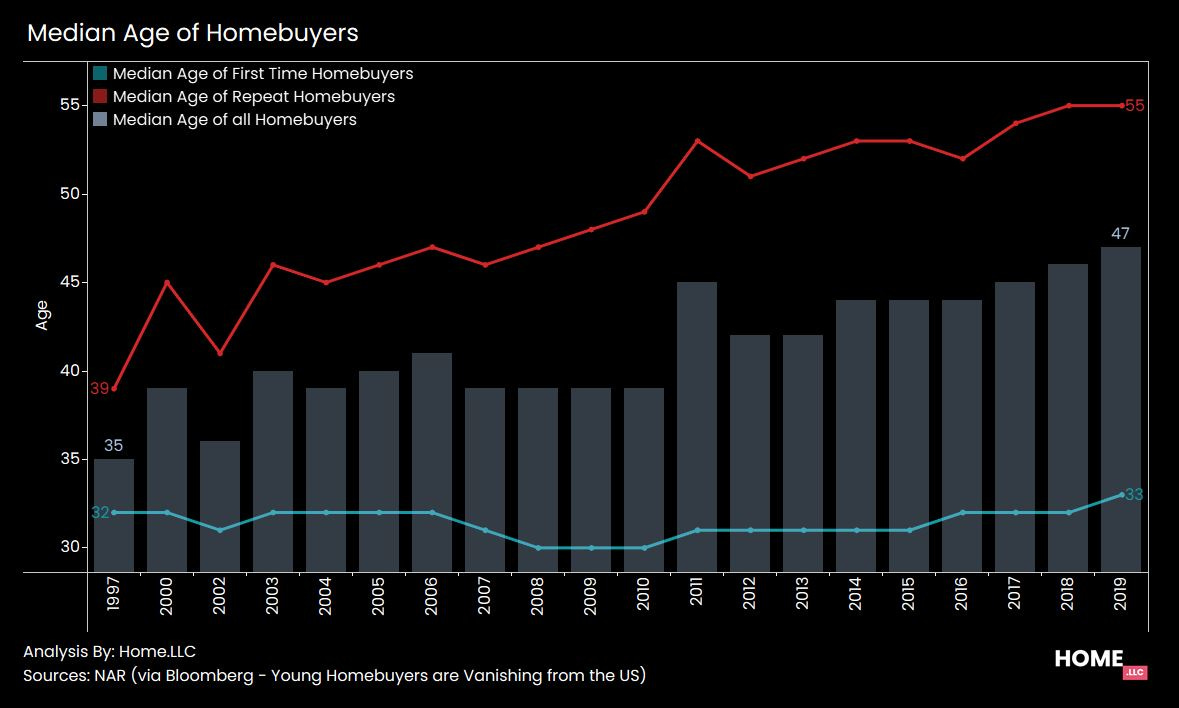

In the last 25 years, the age at which people bought their first home has barely changed. But the age at which people bought their subsequent home has changed from 39 to 55 years. This has reduced the inventory of existing homes for sale.

First American’s Chief Economist Mark Fleming explains it best in a recent piece:

Since existing homeowners supply the majority of the homes for sale and homeowners are living in their homes longer than ever and thus not selling, the housing market faces an ongoing supply shortage.

According to First American’s calculations, homeowners lived in their home an average of 5 years in 2007. The same figure in 2021? 10.62 years!

2. Investors love Single-Family homes

Corelogic published a special report on investor home buying in 2019. The author of the report, Ralph McLaughlin, noted:

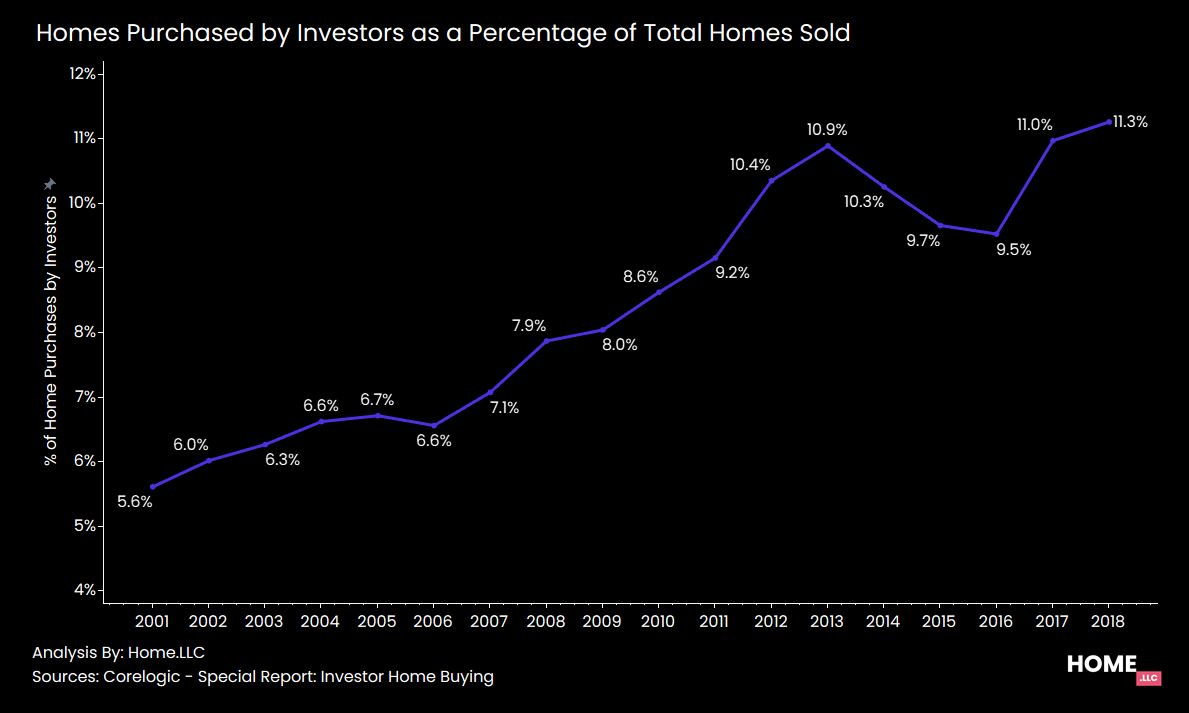

By the end of 2018, the investment rate in the U.S. housing market reached 11.3% – the highest rate since CoreLogic started tracking these data in 1999.

Investment interest in US residential real estate has grown by nearly 100% in 20 years - from 5.6% of sales in 2001 to more than 11% of sales in 2018.

Our hypothesis is that most of these homes don’t get sold as quickly as residential homes (since investors usually rent them out to earn passive income). This reduces the supply of for-sale inventory, and leads to home price increases!

Given these long-term trends, why is housing inventory increasing now?

Here’s what we told Fortune Magazine about this.

“Seasonality is back”: Home.LLC to Fortune

"After skipping seasonal trends in 2020, our research projects that housing inventory will follow seasonal patterns in 2021, and begin cooling down…” Nik Shah, CEO of Home.LLC.

Housing inventory usually rises during the summer months, as most buyers and sellers with kids prefer to wait till the end of the school year before moving. The housing market cools down during winter, as people have family obligations during the holiday season.

2021 housing inventory is following the same seasonal trends we saw in 2015-2019, and should start moving down from September onwards.

And home prices will continue moving in the same direction they’ve done for the last 100 years and more…up!

Michael Adam Smith of Braeburn Family Office loves real estate! Learn why

Michael Adam Smith, Founder & Managing Partner of Braeburn Family Office, spoke to Home.LLC on the present and future of family offices. Here’s why he thinks real estate is hot:

Real estate has been a major creator of significant wealth since the beginning of society and I see no reason that will not continue. An asset that has a finite supply is going to necessarily create value. The challenge is to fashion the best use of that finite supply. And of course….location, location, location.

Read more about Michael’s perspective and other real estate family offices on home.llc/insights