🏡The Housing Market Is In Big Trouble

Housing affordability is a national crisis. It's only going to get worse.

Rates Are Spinning Out Of Control

As you know, rates suddenly spiked from 3.1% to 5.3%, the fastest rise in 30 years!

Similarly high rates were last seen in 2009.

This is causing a massive affordability crisis.

Monthly mortgage payments for median homes are up 44% since January.

The Affordability Crisis Will Only Get Worse

The median priced home costs $425K, while the median American can only afford a $373K home.

This affordability gap of $52K is the highest on record.

But, Home Prices Won’t Crash Yet

Resale inventory, which is already near record lows, might actually worsen.

Why? Because 90% of home owners have a mortgage <5%. Most won’t sell their homes in a high mortgage rate environment.

Instead, Home Prices Will Start To Decelerate

Home prices grew at record pace from 2010 to 2022 because they were very affordable. They are not affordable anymore.

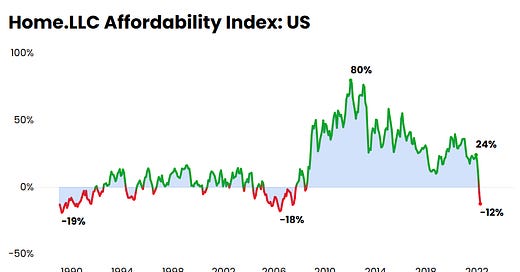

The Home.LLC Affordability Index shows how quickly the situation has deteriorated everywhere.

Today, the median American can only afford a home worth 12% less than the median priced home in the US!

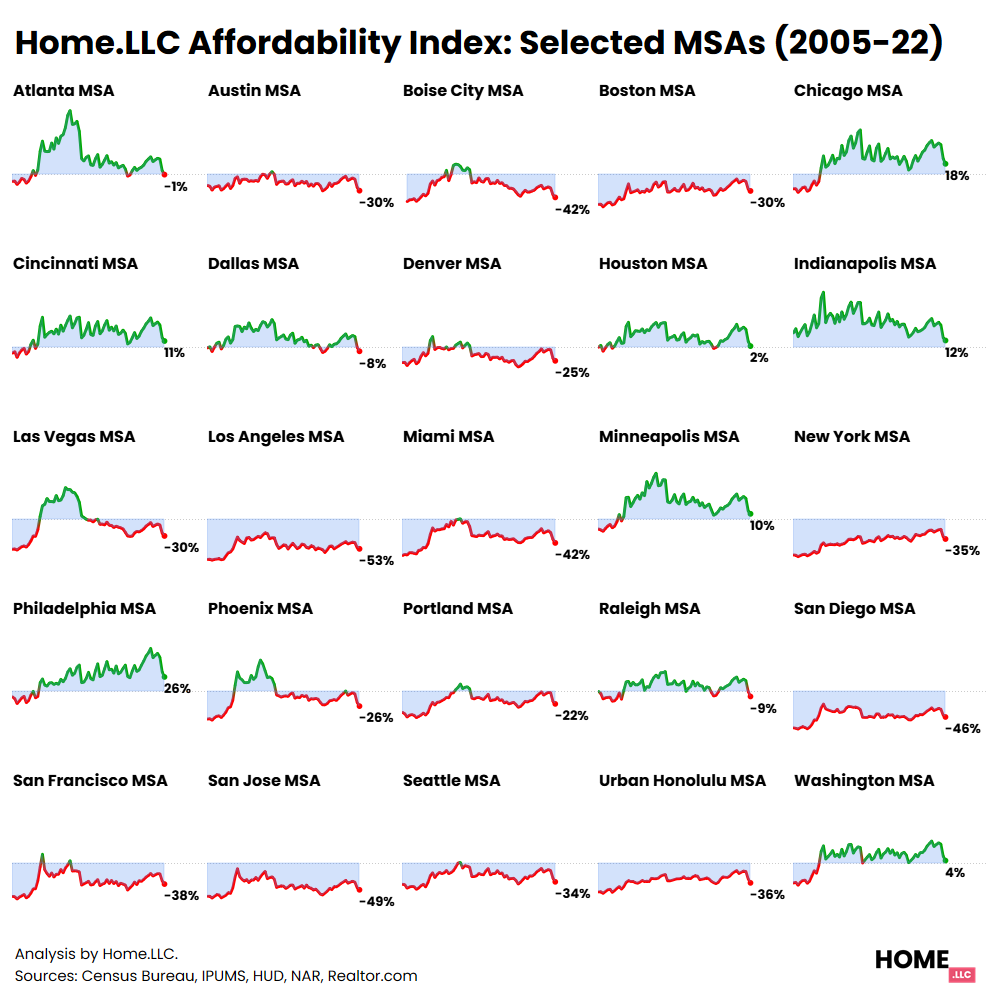

Affordability is even worse in some of the top US metros.

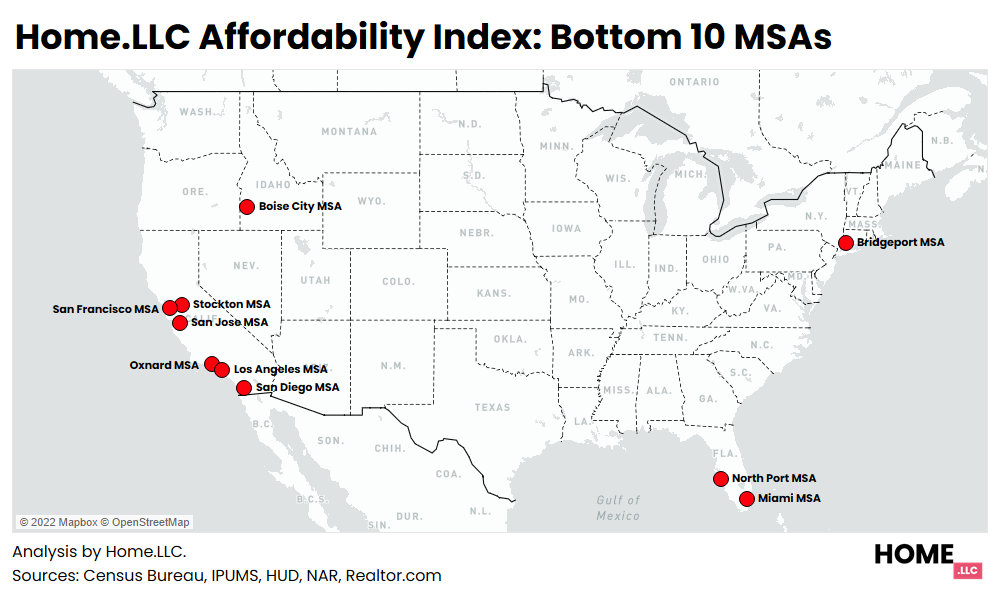

California MSAs are the least affordable

Of top 100 MSAs, 6 of the least affordable MSAs are located in California.

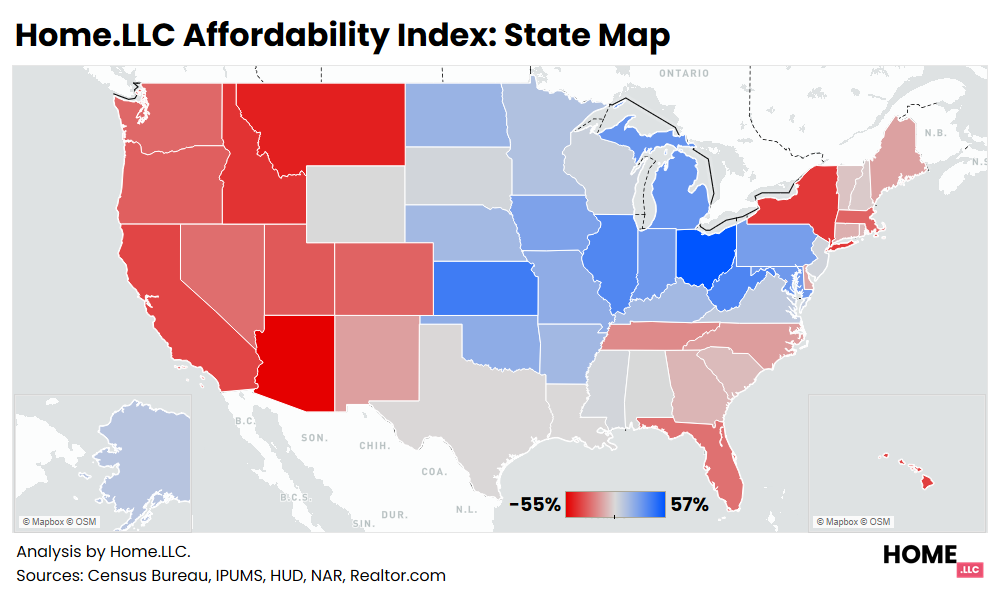

Arizona Locals Are Struggling The Most. But The Midwest Is Still Very Affordable.

Most home buyers in Arizona can’t afford to live locally anymore.

Meanwhile, you can get the most bang for your buck in Ohio.

We are the only real solution

Home buyers love our equity investment solution because

They reduce their loan amount

They eliminate mortgage insurance

They tend to get a lower mortgage rate

Our waitlist has now crossed $1B, and we’ll double it in a few months.

Increasing supply will take too long and is too risky.

Everyone wants affordable housing but no one wants their house to be suddenly affordable.

So, when will home prices crash?

Phoenix, Boise and Miami could tell us when.

In our next piece, we’ll explain why.

Meanwhile…

Our investors are enjoying their exposure to recession-proof and inflation-proof properties in trophy neighborhoods.

Send me a note if you want to invest in data-backed real estate assets.