🏡 How Will The Fed Affect Home Prices In 2023?

Economic conditions are evolving but the Fed remains hawkish so far.

In Summary

We think the Fed will increase rates by 25bps in Feb & in March to bring the target rate to 4.75% - 5.00%.

Here are 3 possible scenarios from April:

If the Fed keeps hiking rates past 5.00%, we’ll see an equities correction and a housing market correction.

If the Fed pauses hikes at 5.00%, the 30-year mortgage will keep on declining to ~5.80% (currently: 6.13%). Home prices will bottom & slowly start climbing again.

If the Fed pivots and starts dropping rates, mortgage rates will decay even faster, and we’ll end 2023 with a ~4% YoY appreciation in home prices.

Inflation Fears Are Receding

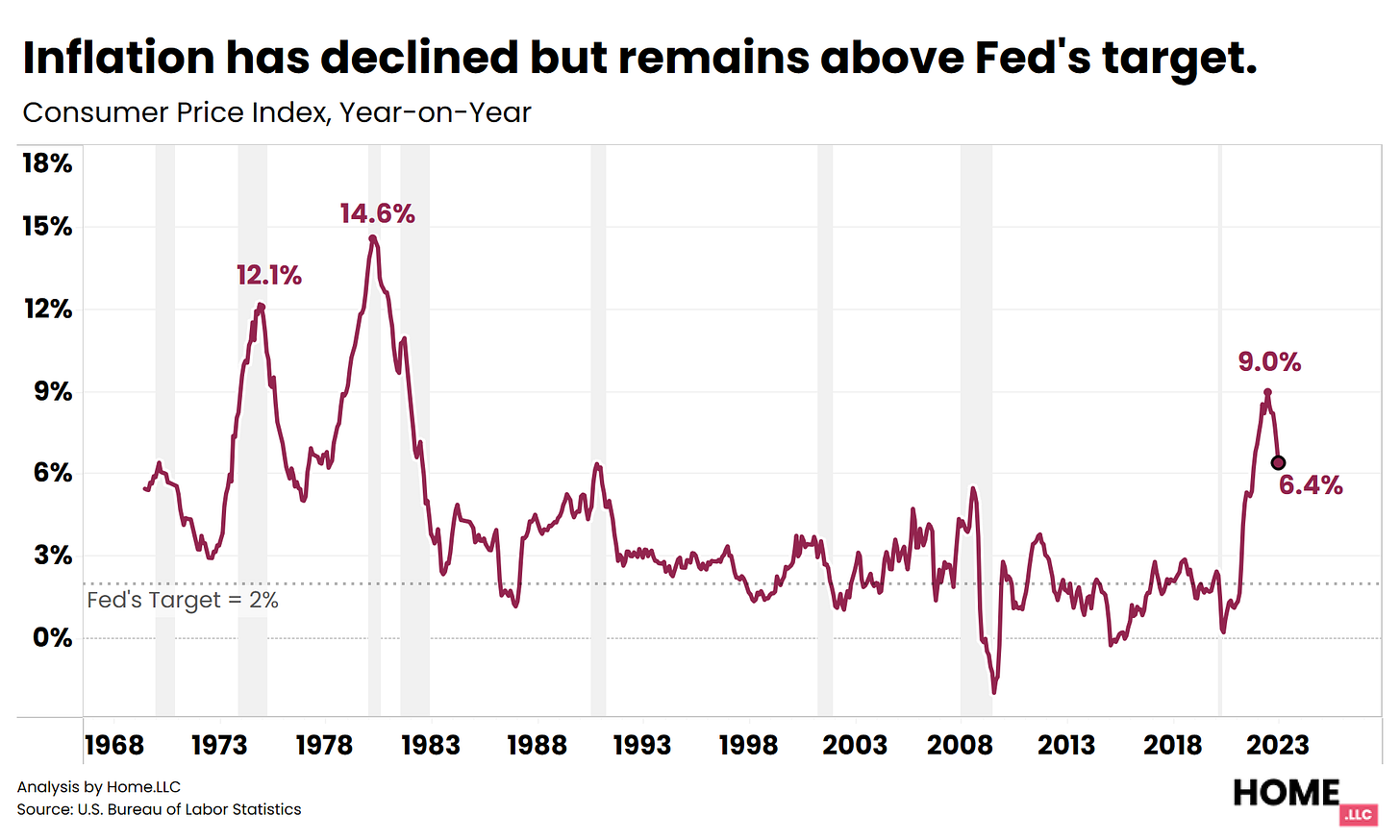

As you know, inflation has plummeted in recent months from 9% to 6.4%.

But…it’s still way above the Fed’s 2% target rate.

While the equities market feels great about decaying inflation, seems like The Fed wants to be too-late, instead of too-early.

Meanwhile, The Job Market Is Robust

Currently, there is a 4 million gap in the labor market, which is 4x pre-pandemic levels!

This labor crunch has created record-high wage growth.

While the Fed wants to reduce wage growth, high rates haven’t done much so far! So, the fed will keep trying harder to crash the labor market.

Meanwhile, Housing Is Accelerating Again!

Mortgage rates have declined in the last 3 months as rate hikes have slowed.

So, mortgage applications are already rapidly increasing in Jan ‘23 after a slow Q4.

While some markets will still have price corrections, it seems like home prices are close to their bottom. Especially if the Fed stops hiking rates soon (i.e. no rate hikes from April).

Our Prediction

We still believe that home prices will increase 4% YoY in 2023 presuming a Fed pivot.

Why?

Projected demand of 5M homes in 2023

Dramatically low supply of ~0.7M homes currently

Fed’s hawkishness will eventually crash the labor market, leading to a pivot

As of now:

Buyers are tired of waiting for lower prices and lower rates.

So, they are getting 5-yr and 7-yr ARMs instead of 30-yr FRMs

Most owners aren’t selling as they’re locked-in to dirt cheap rates

So most listings are dilapidated homes or new constructionsHomes in many markets are already starting to get multiple offers

We’ll learn more during this summer rush…

What do you think?

Note: All statements above are subject to revisions based on changing assumptions and market conditions. Figures could be rounded by +-10% for improving readability. We are neither a tax advisor nor a financial advisor and none of our statements should be interpreted as tax advice or financial advice.